small cap tech etf reddit

You may struggle to find a small-cap ETF with more. ETFs Tracking The SP SmallCap 600 Information Technology Index ETF Fund Flow.

Wallstreetbets And Gamestop Reddit Investing Frenzy Spreads Overseas

My main portfolio is VTIVXUS.

. What small and mid cap ETFs do you recommend adding to a four fund portfolio of VTI and VXUS. I think the us economy is currently the most predictabke market in terms of overall historic performance so Im mainly there but I believe the international market is a good one as technology raises the global standard of living more and more. The iShares Core SP Small-Cap ETF scores big points for its liquidity and costs despite holding far fewer stocks than most ETFs on this list.

Listed Highland Capital Management ETFs. Vanguard Russell 2000 Growth ETF VTWG up 386. I was going with Vanguards small cap value VBR but recently read in Bernstein that Vanguards small cap value funds as many of them include a lot of small cap blend stocks in the mix.

AVUV is arguably the best US small cap value ETF. Discover new investment opportunities with exclusive in-depth analysis and ratings. As the SPX is largely tech they are overweight technology.

It currently carries a Zacks ETF Rank 2 Buy with a Medium-risk outlook read. With over 90 billion in assets it is the one of the most popular ETFs to capture the small cap market segment. Ad Browse Morningstars latest ETF fund research.

Small Cap Technology ETFs give investors exposure to tech stocks with market caps below 2 billion. Opinions on small cap value tilt - XSVM. Small cap tech etf reddit Tuesday March 8 2022 Edit.

Typically these are stocks with market caps between 300 million and 2 billion. Small Cap Technology ETF List. Ad Bold Trades on Technology - In Either Direction Bull or Bear.

At no additional cost to you if you choose to make a purchase or sign up for a service after clicking through those links I may receive a small commission. FINX from Global X is the oldest fund in this space and has over 1 billion in assets. Was wondering opinions on having a small cap value tilt using XSVM or another small cap value ETF AVUV.

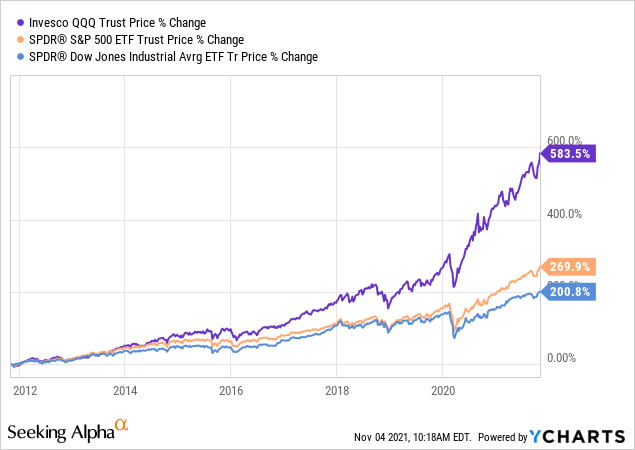

Im surprised that a smallmid cap tech etf or fund is so hard to find. Large cap growth stocks have smoked the market in recent years thanks to Big Tech. What are the best small cap value ETFs out there.

Globally diversified although USA only is fine 7. Vanguard Small Cap ETF List. The 7 Best Small Cap ETFs 3 From Vanguard for 2022 The 6 Best REIT ETFs To Invest in Real Estate for 2022 The 5 Best Tech ETFs To Buy Tech Stocks in 2022 9 Best Clean Energy ETFs To Go Green in Your Portfolio 2022 The 12 Best Small Cap.

Our Financial Advisors Offer a Wealth of Knowledge. Op 1y edited 1y. MOON - a new etf only 2 months old but from Direxion who have been running the popular 3x leveraged etfs since 2008.

This ETF gets you broad exposure to the mid-cap range of stocks with over 350 holdings and seeks to track the CRSP US Mid Cap Index. Large cap value fund. Click on the tabs below to see more.

I do s. The funds cover a wide range of stocks nations industries and sectors. The funds focus on the domestic technology sector.

The Vanguard Small-Cap ETF VB seeks to track the CRSP US Small Cap Index. Contact a Financial Advisor. The technology ETF has posted outstanding returns in the last 1 3 5 and even 10 year periods and if you have owned this ETF over the last decade you have simply crushed the broader TSX Index.

His top picks are Sleep Country Canada and BRP Inc. The table below includes fund flow data for all US. The fund captures companies in developed markets around the world that get most of their revenue from fintech insurance wealth management payment solutions lending crowd funding blockchain and more.

The ETF has an average annual return of 1868 over the last 10 years and more impressive is its near 40 average annual returns over the past 3 years. The fund seeks to track the MSCI US Investable Market Information Technology 2550 Index providing broad exposure to the tech sector in the United States. If youre looking for a more simplified way to browse and compare ETFs you may want to visit our ETF Database Categories which categorize every ETF in a single best fit category.

And of course Avantis also offers AVDV and AVES. And throw in some XLK and TDIV for bigcap tech to balance yourself and get fatoldcap tech sweetass divis to toss into more small cap tech etfs. Fund Flows in millions of US.

Searching for Financial Security. The fund has over 100 billion in assets and a low expense ratio of 004. I also invested in DLS and DGS to give some international exposure.

Some of the links on this page are referral links. Here well list some of the best large growth ETFs. 5 Best Small-Cap ETFs as Russell 2000 Tops SP 500 YTD.

The Vanguard Mid-Cap ETF VO is the most popular ETF for the mid cap market segment and for good reason. The Vanguard Information Technology ETF VGT is one of the most popular tech ETFs on the market with over 38 billion in assets. The pro small cap value investors like Merriman and others usually recommend SLYV and IJS in a taxable account I opted for the latter.

I wouldve thought that it would be a good way to identify and invest in the next generation Google or Facebook. Basically they take the SPY and cut it down from 500 companies to 30 companies. Find your next great investment.

What are the purest small cap value funds or ETFs. The fund has over 1300 holdings and an expense ratio of 005. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Vanguard Small Cap ETFs seek to track the smallest market-capitalization stocks trading domestically and internationally. Provides exposure to both value momentum factors that work really well together to smoothen volatility. Ad Discover Investment Options that Align with Your Goals.

The fund is market cap weighted and. Accumulating rather than distributing any dividends 8. FINX Global X Fintech ETF.

This is a list of all Small Cap Biotechnology ETFs traded in the USA which are currently tagged by ETF Database. MicroSmall cap shares only nothing larger than small cap and no bonds Passively managed eg following an index or rules Ideally. Please note that the list may not contain newly issued ETFs.

The tech sector features companies that do business in the various computer software hardware IT services and other electronics segments. Only holds firms with positive earnings no firms making losses 9.

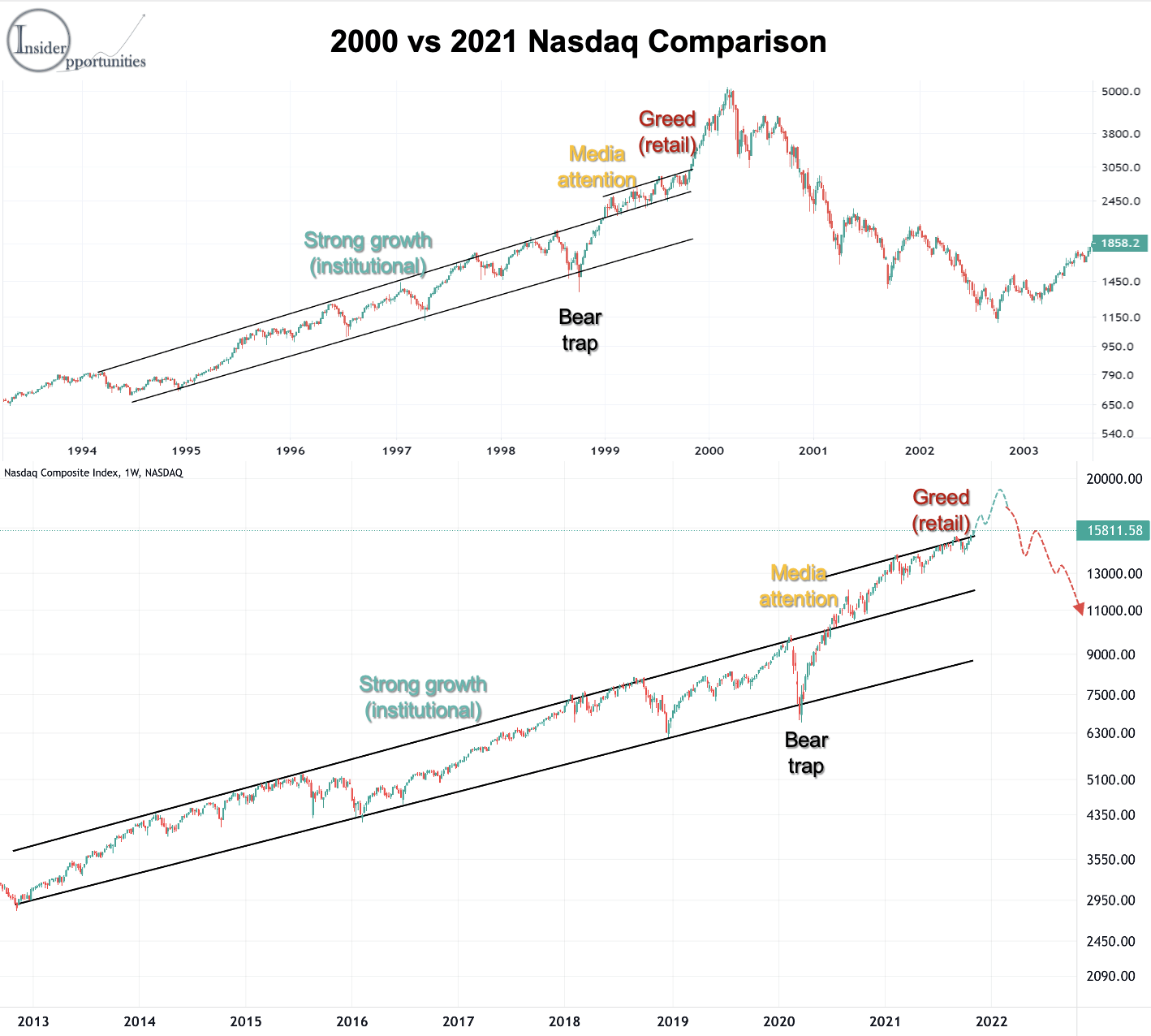

Qqq Be Prepared For The Biggest Tech Rally In Your Lifetime Nasdaq Qqq Seeking Alpha

Buy These 5 Strong Quant Scored Technology Stocks After The Drop Seeking Alpha

Tech Only Portfolios Are Too Risky R Etfs

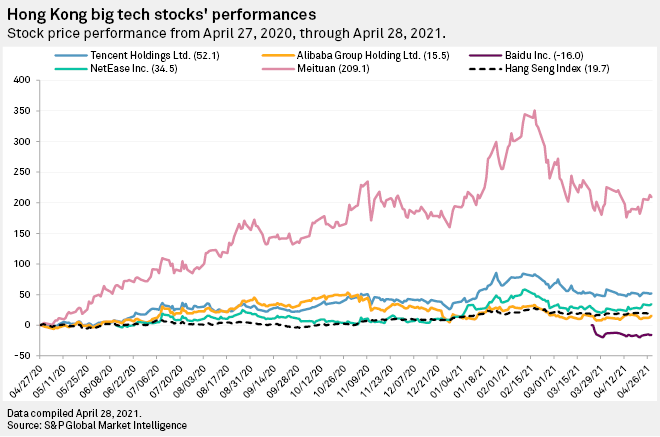

China Tech Stocks May Recover As Most Regulatory Risks Priced In Analysts Say S P Global Market Intelligence

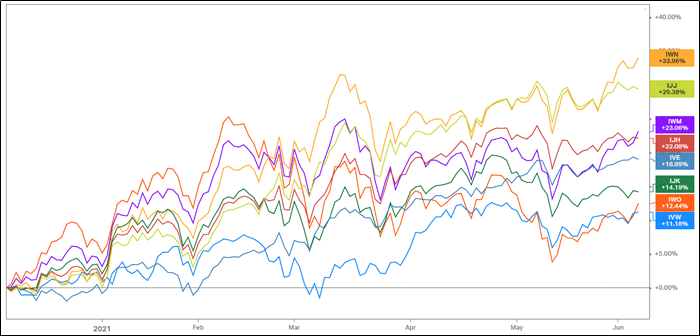

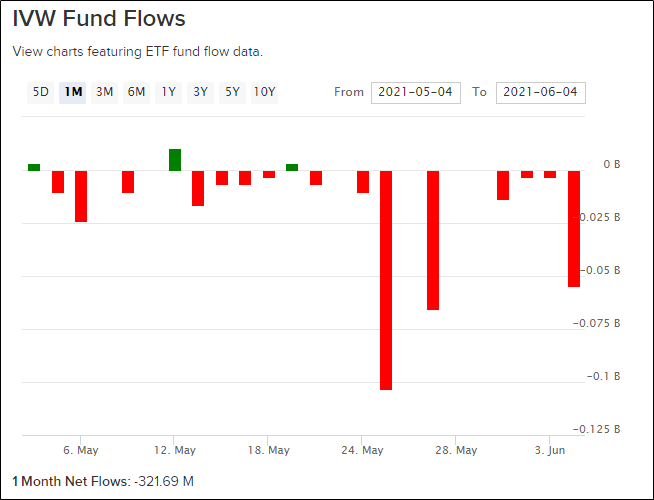

Ivw Etf Big Tech Sidelining Only Transitory Nysearca Ivw Seeking Alpha

Ivw Etf Big Tech Sidelining Only Transitory Nysearca Ivw Seeking Alpha

The 5 Best Tech Etfs To Buy For Safer Growth Ibb Xsd Arkq Investorplace

Best Small Cap Etfs In April 2022 Bankrate

Spy Vs Voo Vs Ivv There Is A Difference Between These S P 500 Etfs Etf Focus On Thestreet Etf Research And Trade Ideas

Finally Built It Introducing My Qmk Converted Gon Nerd60 Diy Mechanical Keyboard Computer Setup Keyboard

Tech Only Portfolios Are Too Risky R Etfs

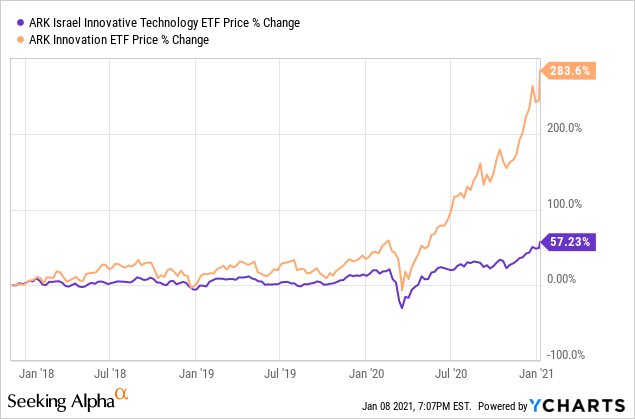

The Ark Invest Hidden Gem Israel Innovation Technology Etf Bats Izrl Seeking Alpha

Information Technology Etf Iuit R Etfs

Short Selling By Hedge Funds Is Focus Of Criminal Probe By Doj Bloomberg

Nfts Are Not Art An Immersive Guide By Gloryinvestingshow

Qqq Be Prepared For The Biggest Tech Rally In Your Lifetime Nasdaq Qqq Seeking Alpha

Arkk Vs Arkw Vs Arkf Which Ark Disruptive Tech Etf Is Better For Your Portfolio Right Now Etf Focus On Thestreet Etf Research And Trade Ideas

Tech Only Portfolios Are Too Risky R Etfs

Custom Keyboard Black 60 Keyboard Keyboard Keyboard Technology